Accumulated depreciation formula excel

8 Methods to Prepare Depreciation Schedule in Excel. Accumulated Depreciation Calculator.

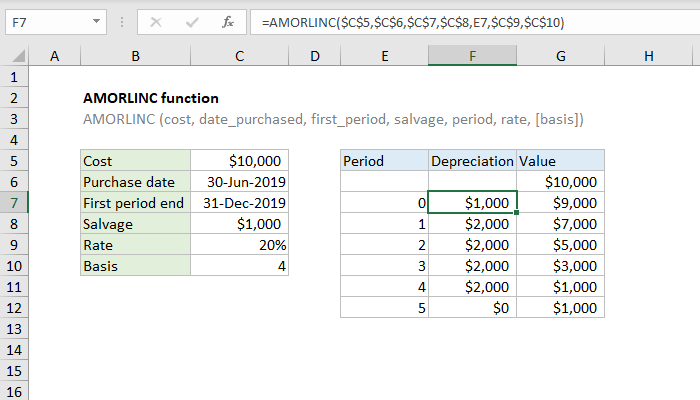

How To Use The Excel Amorlinc Function Exceljet

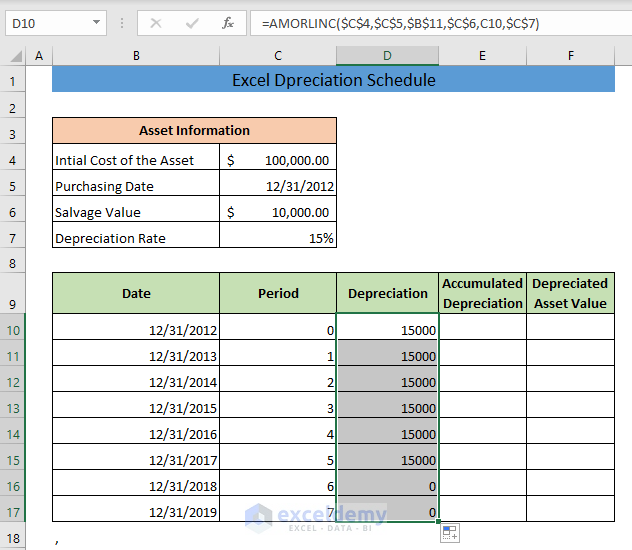

IF B11.

. During each period of an assets lifetime the straight line technique. Calculate Accumulated Depreciation by Given Information Cost of the Machinery. Straight Line Depreciation Schedule.

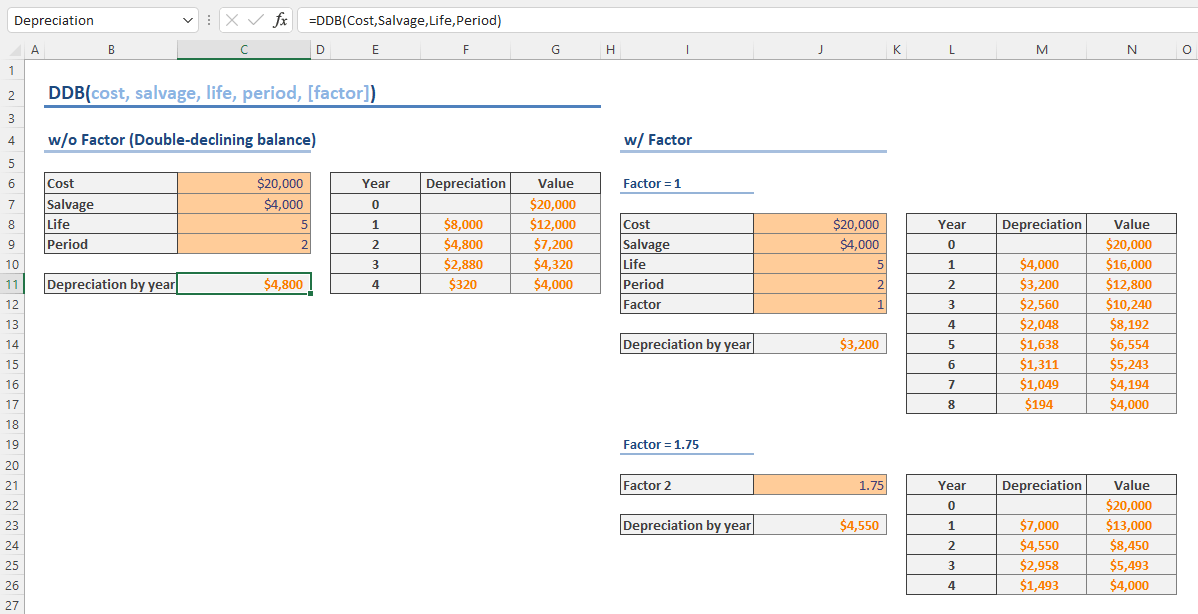

Annual Depreciation Depreciation Factor x 1Lifespan x Remaining Book Value. Accumulated Depreciation Excel Template Visit. This Accumulated Depreciation Calculator will help you compute the period accumulated depreciation given the purchase price useful.

To do this under Straight Line I used. Per the period for which the depreciation is being calculated. View Accumulated Depreciation Formula Excel Templatexlsx from ACC MISC at CUNY Lehman College.

Excel SYD Function Example If you have an asset that cost 1000 and has a residual value of 100 after 5 years you can calculate. C45 E2-D4365 but if E2 - D4 is greater than 1825 then just write C4 value in C4 I mean. B9 is depreciable base divided by D5 useful life.

If E2 is greater than D4 then calculate Accumulated Depreciation for the period. Calculating Accumulated Depreciation Formula will sometimes glitch and take you a long time to try different solutions. Adapt this to a monthly depreciation formula with these steps.

Login Self Study Courses All Self Study Programs Financial Modeling Packages Premium Package Basic Package Industry Specific Modeling Private Equity Masterclass Project Finance. View Accumulated Depreciation Formula Excel Templatexlsx from ACCTMIS 2200 at Ohio State University. How to prepare Assets schedule in Microsoft ExcelThis video helps you to understand that how to make a spread sheet of Depreciation accumulated depreciati.

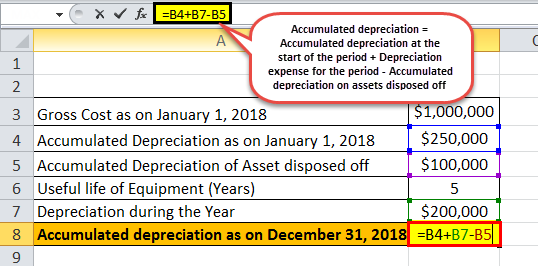

Subtract the assets salvage value from its. Depreciation Expense Total PPE Cost Salvage Value Useful Life Assumption Depreciation represents the allocation of the one-time capital expenditure cash outflow. Accumulated Depreciation Formula Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation.

The formula for calculating Straight Line Depreciation is. Depreciation Per Year Cost of Asset Salvage Value Useful Life of Asset. To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using.

Actual cost of Acquisition of an Asset. LoginAsk is here to help you access Calculating Accumulated.

Depreciation Calculator

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

How To Use The Excel Db Function Exceljet

Depreciation Schedule Template For Straight Line And Declining Balance

Get Flexible Balance Spreadsheet Templates Excel Spreadsheet Templates Spreadsheet Template Excel Spreadsheets Templates Spreadsheet

2

Using Spreadsheets For Finance How To Calculate Depreciation

Create Depreciation Schedule In Excel 8 Suitable Methods Exceldemy

Sales Price Estimate Template Download Excel Worksheet Estimate Template Estimate Templates

How To Calculate Depreciation In Excel

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

Accumulated Depreciation Definition Formula Calculation

An Excel Approach To Calculate Depreciation Fm

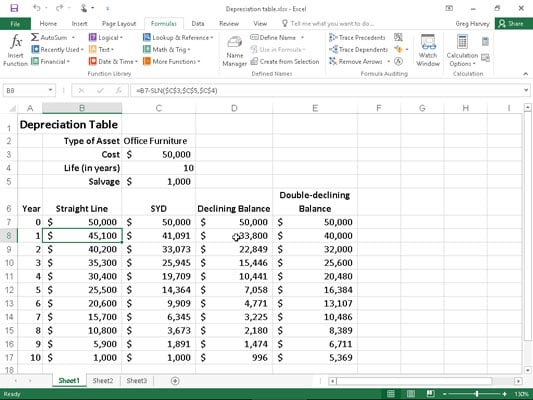

How To Use Depreciation Functions In Excel 2016 Dummies

How To Use The Excel Ddb Function Exceljet

Business Plan Templates 40 Page Ms Word 10 Free Excel Regarding Microsoft Business Business Plan Template Simple Business Plan Template Simple Business Plan

Calculating Depreciation Using The Sln Function Extra Credit