Mortgage calculator with extra principal payments and lump sum

Mortgage loan basics Basic concepts and legal regulation. So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half.

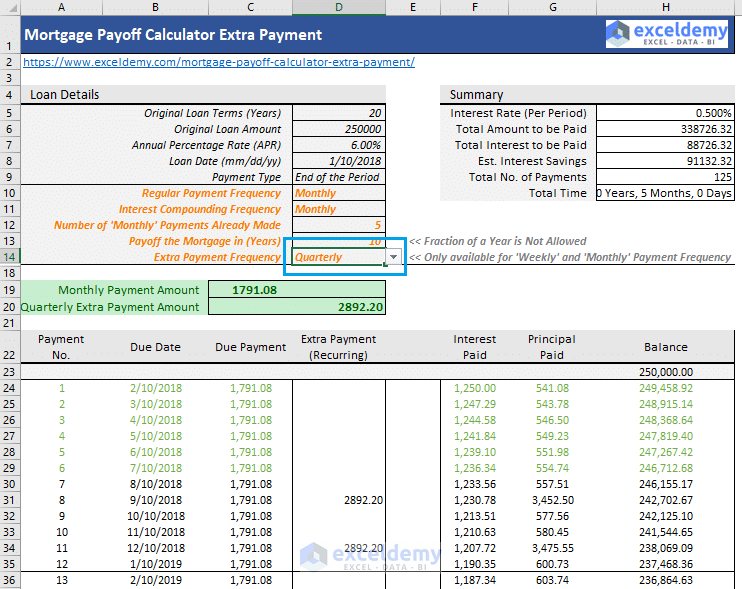

Mortgage Payoff Calculator With Extra Payment Free Excel Template

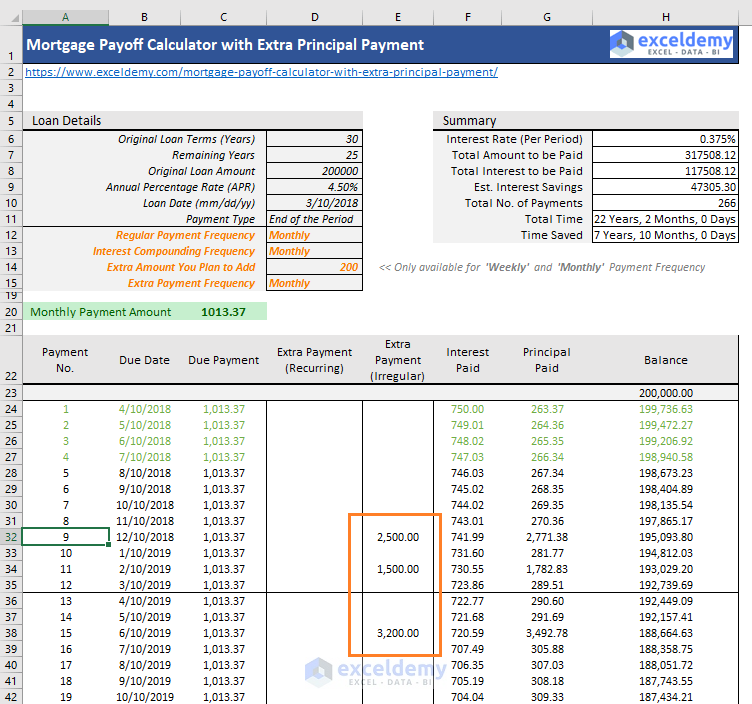

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization.

. 30-Year Fixed Mortgage Principal Loan Amount. Starting from the first year of your loan. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way.

This is the best option if you are in a rush andor only plan on using the calculator today. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly. Recasting usually charges fees around 200-300.

We also generate graphs summaries of balances payments and interest over the life of your mortgage. Recurring extra payments add up to reduce your principal balance. What is a lump sum mortgage payment.

Mortgage Calculator with Lump Sums. Four alternatives to paying extra mortgage principal. Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals.

In a year you might receive lump sum payments in the form of an annual work bonus or a windfall from a business venture. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs.

Noun a single payment made at a particular time as opposed to a number of smaller payments or installments. If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. Additionally the term of the mortgage can be drastically reduced by making extra payments or a lump sum.

Regardless of the amount of funds applied towards the principal paying extra installments towards your loan makes an enormous difference in the amount of interest paid over the life of the loan. A home equity loan is issued as a lump-sum and is determined based on the current value. Up to five recurring or up to ten one-time lump sum payments.

You can calculate both recurring extra payments an additional lump sum payment by entering the details for each in the calculator. Interest 3 729. Recasting your mortgage is an excellent way to lower your monthly payment while keeping your interest rate and avoiding the fees that come with refinancing.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance. Check your mortgage contract for the specific amount. Total of 360 Payments.

The lender then modifies your amortization schedule to reflect your new balance. Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel xlsx xls or pdf format. Advanced Extra Mortgage Payments Calculator.

At certain times during your term. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Biweekly Mortgage Calculator with Extra Payments.

Extra Mortgage Payment Calculator 47. You can make lump-sum payments. If you want to reduce interest costs you must budget for extra mortgage payments.

Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. In that case set the number of extra payments to Unknown When the extra payments are off-schedule the calculator prepares an expanded amortization schedule showing the payment being applied 100 to the principal with interest accruing. A lump sum mortgage payment is a one-time payment that you can put down on your mortgage when you have extra funds.

Use this simple online mortgage calculator to easily estimate your monthly mortgage payment interest rates and taxes. This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments. Balloon loan schedule with interest only payments and a lump sum extra payment.

You may only be able to put a limited amount of money toward your mortgage. Mortgage Amount or current balance. You can also use the calculator on top to estimate extra payments you make once a year.

Is approaching 400000 and interest rates are hovering around 3. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. You will spend on principal on interest.

Make a lump-sum payment toward the principal. At the end of your term. This mortgage calculator with extra payment allows you to add extra contribution to every payment.

Before the end of your term. Make Lump Sum Loan Payments. This is advantageous if you have an extended loan such as a 30-year mortgage.

Extra Payments In The Middle of The Loan Term. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

The amount of time saved on the current loan schedule by making additional payments toward the principal mortgage balance. For accelerated payments youre paying an extra 2000 per year equivalent to an extra monthly mortgage payment. Combining both strategies can make an even.

A lump sum payment could make sense if your lender lets you recast the mortgage afterward meaning your lender would apply the lump sum to your principal and create a new payment schedule based on the reduced loan. Principal 393 1119. If you want to make a lump sum extra payment of 1000 enter it.

You may also enter extra lump sum and pre-payment amounts. But if you have large funds you can use it to decrease a considerable portion of your loan. Extra Lump Sum Payment.

For example if you are 35 years into a 30-year home loan you would set the loan term to 265. You can make a lump-sum payment on top of your regular mortgage payments. Make a lump-sum payment.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. This extra mortgage payment will pay down your mortgage principal faster meaning that youll be able to pay off your mortgage quicker. You might do this after receiving a bonus inheriting money or winning a lottery prize any time a large sum lands in your checking account.

Consider how long you plan on living in the home. This is the best option if you plan on using the calculator many times over the. Monthly mortgage payment Your monthly mortgage payment has four components.

Making a one-time lump sum payment could lower your monthly mortgage payments and save you on interest over the long run. It involves paying a lump sum toward the principal amount. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use.

If youve crunched the numbers and feel confident that you can swing paying extra each month or through lump-sum. Depending on your mortgage some will let you do a lump sum payment. How much of a lump sum payment you can make without penalty depends on the original mortgage principal amount.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator With Extra Payments Payment Schedule

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Mortgage Calculator With Extra Payments Top Sellers 50 Off Www Wtashows Com

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator How Much Will You Save

Advanced Mortgage Calculator With Extra Payments Make Additional Weekly Monthly Biweekly Yearly And Or One Time Home Loan Payments

Mortgage Calculator With Extra Payments Top Sellers 50 Off Www Wtashows Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Lump Sum Extra Payment Calculator Mentor

![]()

Extra Mortgage Payment Calculator Accelerated Home Loan Payoff Goal

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template